For any growing business, acquiring necessary equipment is crucial for efficiency, expansion, and staying competitive. However, investing in new machinery or technology can often demand significant upfront capital, straining precious cash reserves. At Swiftbridge Capital, we understand the challenges brands face in Los Angeles, CA, and beyond; that’s why we champion commercial equipment financing as a strategic solution, enabling businesses to acquire the assets they need without compromising their financial agility. Learn more about how our equipment finance loans can make a difference for your operations!

Preserving Your Working Capital

One of the most compelling benefits of an equipment finance loan is its ability to preserve your working capital. Instead of making a large lump-sum payment, you spread the cost over time through manageable monthly installments. This keeps your cash flow healthy, allowing you to allocate funds to other vital areas like inventory, marketing, or unexpected operational needs, ensuring business stability and growth.

Accessing Up-to-Date Technology

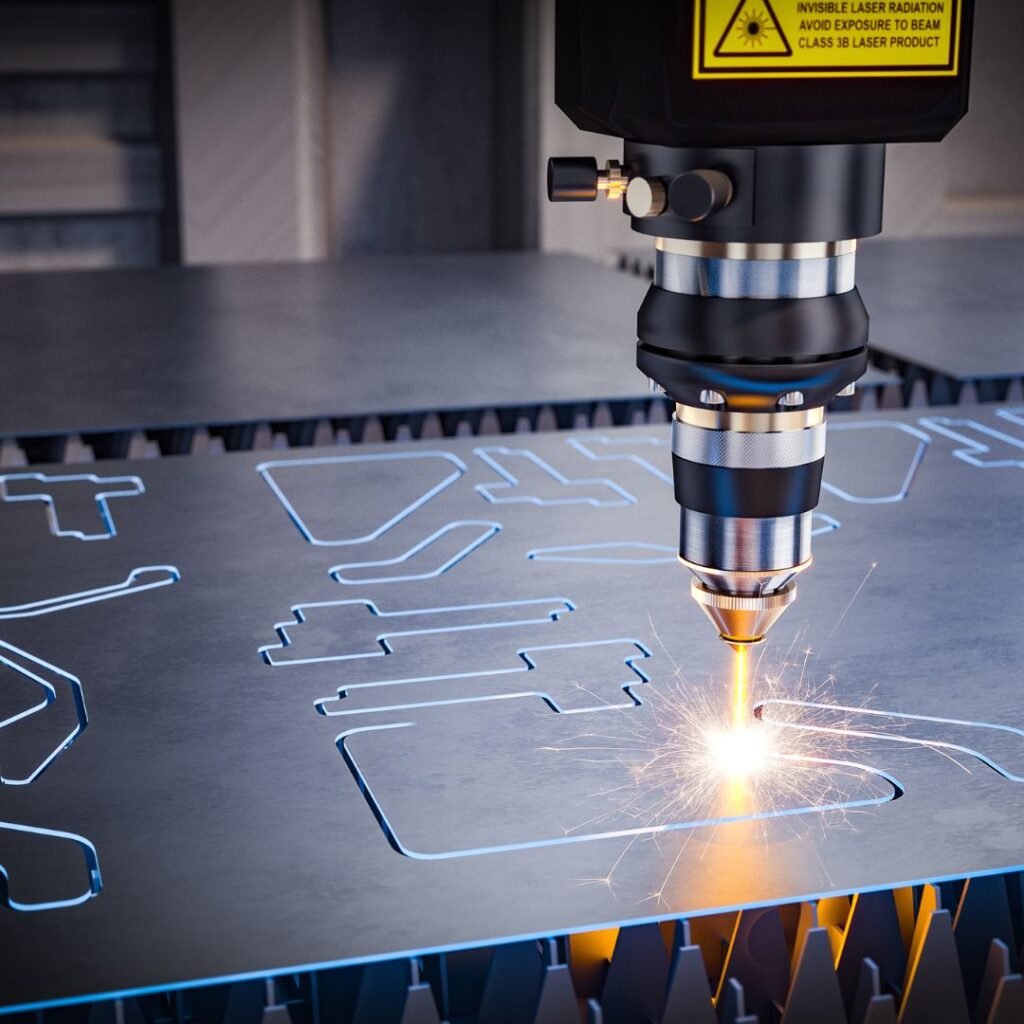

Having access to the latest technology and equipment can provide a significant competitive edge. Equipment financing allows businesses to acquire state-of-the-art machinery sooner than if they had to save up for a full purchase. This ensures your operations remain efficient, productive, and competitive, helping you serve your customers better and expand capabilities.

Tax Advantages & Budget Predictability

Commercial business equipment financing can offer attractive tax advantages, such as deductions under Section 179 for eligible equipment, allowing businesses to write off the full purchase price. The fixed monthly payments provide clear budget predictability, and this consistent expense makes financial forecasting simpler, allowing you to manage your cash flow effectively without unexpected financial surprises.

Flexible Repayment Options

We understand that every business has unique financial rhythms. Many equipment financing solutions come with flexible repayment terms designed to align with your business’s cash flow cycles, whether that means seasonal payments or varying loan durations. This adaptability ensures that your repayment schedule supports your operational needs, rather than hindering them, providing tailored financial support.

An equipment finance loan from Swiftbridge Capital is a powerful tool that empowers businesses to grow, innovate, and thrive without sacrificing liquidity. By offering an accessible and strategic path to acquiring essential assets, it supports long-term success. Contact us today to explore how a tailored equipment finance loan can provide the perfect solution for your business needs!