Empowering Startups with

Small Business Loans

At Swiftbridge Capital, we specialize in providing tailored small business loans designed specifically for startups. With our streamlined application process, you can access the capital you need to launch and grow your business. Click the button below to get started today!

Terms

3-24 Months

Rates

As low as 10%

Amount

Up to $1m

Time to Fund

24 Hours

Streamlined Small Business Loan Solutions

Our small business loans offer a versatile and unsecured financing option for new ventures seeking fast access to capital. This solution allows you to leverage your projected earnings, enabling you to borrow amounts up to one million dollars. With repayment terms ranging from three to twenty-four months, you can align your funding with your business’s cash flow, ensuring smooth operations from the get-go.

Key Benefits of Small Business Loans

We understand that startups have unique needs, which is why our repayment terms are designed to offer flexibility. This means that you can tailor your payments based on your revenue, reducing stress and allowing you to focus on growing your business.

Cash Flow Management

One of the primary benefits of a business line of credit is its ability to help manage cash flow. It provides immediate access to capital, allowing businesses to cover operational expenses, payroll, and other financial obligations when revenues may be slow to arrive. This ensures your business can run smoothly, even during unpredictable cash flow situations.

Seizing Opportunities

Opportunities for growth often appear quickly, and having a line of credit allows you to act fast. Whether it’s purchasing inventory at a discount, expanding your services, or investing in technology to enhance efficiency, your business can draw cash on demand to capitalize on these instances without hesitation.

Financial Safety Net

Every business encounters unexpected financial challenges at some point. A business line of credit serves as a financial safety net that provides you with peace of mind during tough times. Knowing that you have access to additional funds to address emergencies can help relieve stress and allow you to focus on other aspects of running your business.

Cost-Effective Financing

With a business line of credit, you only pay interest on the amount you actually utilize, making it a cost-effective financing option. This is particularly advantageous compared to traditional term loans, where interest charges accrue on the entire loan amount, regardless of how much you’ve borrowed. By opting for a line of credit, you can minimize costs and maximize your financial resources.

Flexibility

Flexibility is key for any business owner, and a business line of credit offers just that. You have the freedom to borrow and repay as needed, tailoring your financing to suit your specific requirements. This adaptability allows you to manage your debt responsibly and avoid taking on unnecessary financial burdens.

Streamlined Application Process

Obtaining a business line of credit is often straightforward, with minimal documentation required. Our application process is designed to be quick and efficient—meaning you can apply from anywhere with just a few clicks. Within 24 hours, you could have the funds you need right at your fingertips.

Short-Term Business Funding: Is a Cash Advance Right for You?

Short-Term Business Funding: Is a Cash Advance Right for You?

Navigating the landscape of small business finance often requires quick access to capital, and Swiftbridge understands this need. Short-term business funding options, such as business cash advances, provide rapid solutions to urgent financial challenges. However, it’s essential to weigh the advantages against the potential drawbacks before deciding if this funding method is right for you.

Advantages of Quick Access to Capital

One of the most significant benefits of a business cash advance is the speed at which funds are made available. Unlike traditional loans, which can take weeks or months to process, cash advances provide fast cash for businesses, allowing you to seize opportunities or address unforeseen expenses promptly. This accessibility makes cash advances an appealing short-term business funding option for entrepreneurs needing immediate cash flow relief.

Flexibility in Use of Funds

Business cash advances offer remarkable flexibility. Unlike traditional loans tied to specific uses, cash advances can be utilized for various expenses, such as inventory purchases, paying staff, or marketing initiatives. This versatility allows business owners to allocate funds according to their unique needs, maximizing the impact of the provided capital.

Repayment Process Simplified

Another attractive feature of cash advances is their repayment structure. They typically involve daily or weekly deductions based on a percentage of your sales. This means that during slower sales periods, your repayments adjust accordingly, making it easier to manage cash flow without the burden of fixed monthly payments.

Evaluating the Costs

Despite their benefits, these advances can often come with higher costs compared to traditional financing. It’s crucial to evaluate the total repayment amount versus the amount advanced, ensuring that the benefits outweigh the expenses associated with this form of funding.

While a business cash advance can provide much-needed fast cash for businesses, it’s crucial to assess your financial situation thoroughly. If your short-term needs align with the unique advantages of this funding source, it might be the perfect solution for your business. At Swiftbridge, we’re here to help you make informed decisions about short-term business funding that aligns with your unique business needs.

The Advantages of a Revolving Line of Credit for Small Businesses

As small business owners, we understand that having access to immediate funds can be crucial for growth and stability. A revolving line of credit provides that flexibility, allowing us to meet our funding needs as they arise and Swiftbridge understands this need. This financial solution adapts to our unique circumstances and empowers us to seize opportunities as they emerge.

Access to Immediate Funds

One of the most significant advantages of a revolving line of credit is the ability to access funds whenever necessary. Whether we need to cover unexpected expenses or invest in a new project, having a line of credit means we can apply for a business line of credit quickly and receive the support we need without lengthy approval processes.

Pay Only for What You Use

With a revolving line of credit, we only pay interest on the amount we draw. This means we can borrow funds as needed without incurring unnecessary expenses. By optimizing our borrowing, we ensure that our financial resources are used efficiently, allowing our businesses to thrive.

Scalable Financing Options

A line of credit grows with us, adjusting to our changing financial landscape. As our business expands, our available credit limit can increase, providing the funds we need without the hassle of reapplying for loans. This scalability is ideal for small businesses looking to maintain their momentum.

Strengthen Your Credit Profile

Using a revolving line of credit responsibly can enhance our creditworthiness. Regular, timely repayments help establish a strong credit history, making it easier for us to secure additional financing in the future.

A revolving line of credit offers countless advantages for small businesses like ours. By embracing this financial tool, our team at Swiftbridge can ensure flexibility and security in our operations. Let’s explore how we can support your business with a new business line of credit today!

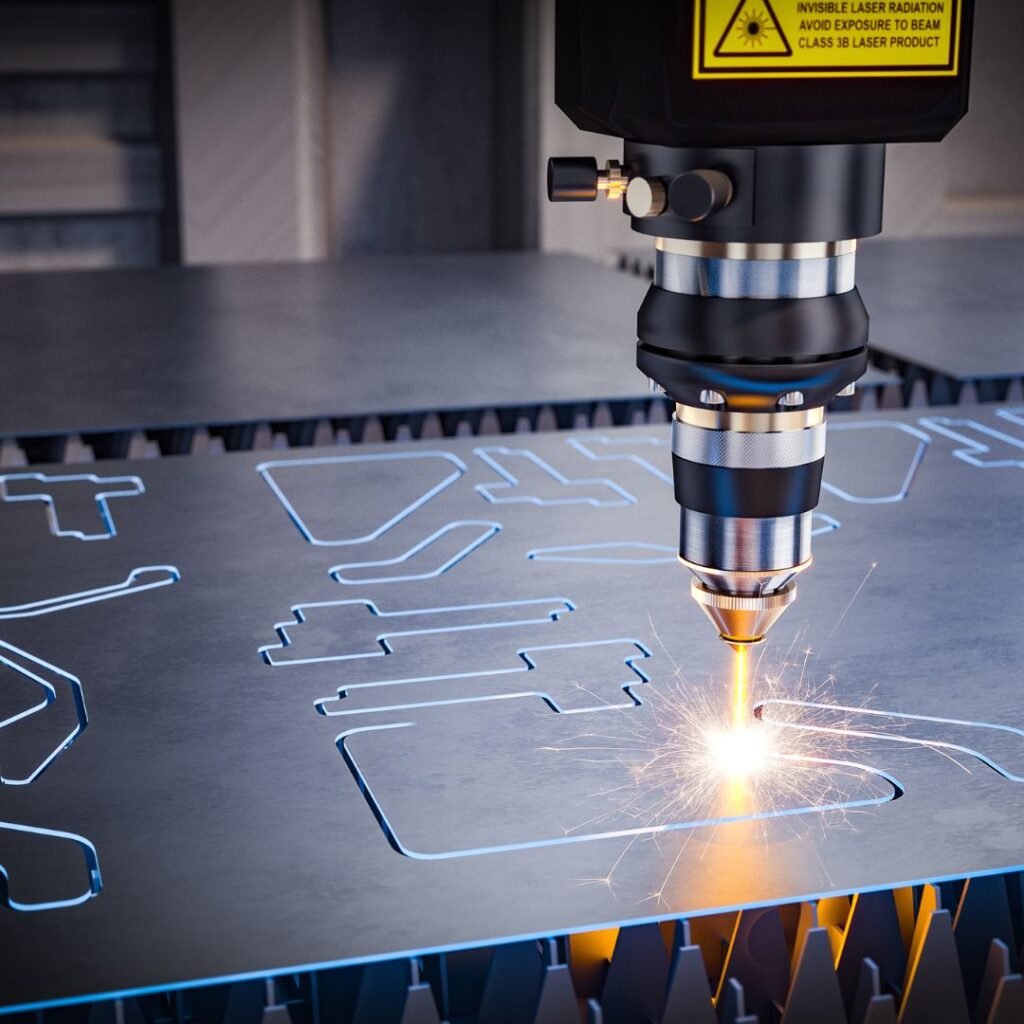

The Benefits of Commercial Equipment Financing for Your Business

For any growing business, acquiring necessary equipment is crucial for efficiency, expansion, and staying competitive. However, investing in new machinery or technology can often demand significant upfront capital, straining precious cash reserves. At Swiftbridge Capital, we understand the challenges brands face in Los Angeles, CA, and beyond; that’s why we champion commercial equipment financing as a strategic solution, enabling businesses to acquire the assets they need without compromising their financial agility. Learn more about how our equipment finance loans can make a difference for your operations!

Preserving Your Working Capital

One of the most compelling benefits of an equipment finance loan is its ability to preserve your working capital. Instead of making a large lump-sum payment, you spread the cost over time through manageable monthly installments. This keeps your cash flow healthy, allowing you to allocate funds to other vital areas like inventory, marketing, or unexpected operational needs, ensuring business stability and growth.

Accessing Up-to-Date Technology

Having access to the latest technology and equipment can provide a significant competitive edge. Equipment financing allows businesses to acquire state-of-the-art machinery sooner than if they had to save up for a full purchase. This ensures your operations remain efficient, productive, and competitive, helping you serve your customers better and expand capabilities.

Tax Advantages & Budget Predictability

Commercial business equipment financing can offer attractive tax advantages, such as deductions under Section 179 for eligible equipment, allowing businesses to write off the full purchase price. The fixed monthly payments provide clear budget predictability, and this consistent expense makes financial forecasting simpler, allowing you to manage your cash flow effectively without unexpected financial surprises.

Flexible Repayment Options

We understand that every business has unique financial rhythms. Many equipment financing solutions come with flexible repayment terms designed to align with your business’s cash flow cycles, whether that means seasonal payments or varying loan durations. This adaptability ensures that your repayment schedule supports your operational needs, rather than hindering them, providing tailored financial support.

An equipment finance loan from Swiftbridge Capital is a powerful tool that empowers businesses to grow, innovate, and thrive without sacrificing liquidity. By offering an accessible and strategic path to acquiring essential assets, it supports long-term success. Contact us today to explore how a tailored equipment finance loan can provide the perfect solution for your business needs!

Navigating the Application Process for SBA Loans

Small Business Administration (SBA) loans represent a vital pathway for many entrepreneurs to secure the capital needed for growth, expansion, or managing cash flow. However, the application process for these government-backed small business loans can sometimes seem daunting, with extensive requirements. At Swiftbridge Capital, we aim to simplify this journey, providing clear guidance as you navigate the various SBA loan options available to your business.

Understanding SBA Loan Types & Eligibility

The first step is to recognize that there isn’t just one “SBA loan.” The most common are the 7(a) loan (flexible financing for various needs) and the 504 loan (for fixed assets like real estate or machinery); each program has specific eligibility criteria and uses. Understanding which financing options align with your business goals is crucial before beginning the application process, saving valuable time.

Meticulously Gathering Your Documentation

SBA loans are known for their comprehensive documentation requirements. You’ll typically need a detailed business plan, historical financial statements (profit and loss, balance sheets), personal and business tax returns, and a personal history statement. Preparing these documents meticulously and having them readily available can help expedite your application’s review process.

Partnering with an Approved Lender

It’s important to remember that the SBA itself does not directly lend money; instead, it guarantees a portion of loans made by approved banks and financial institutions. Finding the right lender is paramount, and Swiftbridge Capital works with a network of experienced lenders familiar with the nuances of SBA loan options, streamlining the connection between your business and the ideal financial partner.

The Review & Approval Phases

Once submitted, your business lending application undergoes a thorough review by the lender, followed by underwriting and, if applicable, SBA approval. This phase requires patience but also readiness to promptly provide any additional information requested. Being prepared for these queries can prevent unnecessary delays, ensuring your small business loans move efficiently towards funding.

While navigating the application process for SBA loans can initially seem complex, with the right preparation and guidance, it becomes highly manageable. At Swiftbridge Capital, we are committed to simplifying this journey for small businesses seeking vital funding for their growth. Contact us today to discuss your small business funding options and begin your path to securing capital.

No Collateral Required for Your Peace of Mind

Unlike traditional loans that often require collateral, our small business loans are typically unsecured. This means you won’t need to risk your assets when seeking funding. With a quick and straightforward application process, your time and effort are minimized. You can complete your application with minimal documentation, allowing you to get back to what matters most—building your business.

A Tailored Financial Solution for Every Startup

Our small business loans are designed to serve as a short-term solution for your financial needs, helping you bridge the gaps without the burden of long-term debt. By choosing Swiftbridge Capital, you are opting for a partner who understands your aspirations and is committed to helping you achieve your goals.

Start Your Journey

with Swiftbridge Capital Today

Don’t let financial constraints hold you back from bringing your business vision to life. Our team is dedicated to supporting startups like yours with tailored financial solutions that empower your growth.